While the headline net jobs gain was a disappointing 10,000–well below the average monthly increase in the past year–the underlying data in this morning’s StatsCanada release were quite robust. The jobless rate remained unchanged at 6.2 per cent as the acceleration in wage gains suggests that the economy is close to full employment. Average hourly pay gains hit 2.2 per cent year-over-year, the fastest pace since April 2016, mostly reflecting a long-awaited acceleration in wages in the past few months. The Bank of Canada has cited sluggish wage growth as evidence of slack in the economy. In a reversal of the pattern in August, the rise in full-time jobs was dominant, up 112,000 offsetting a loss of 102,000 part-time jobs.

Canada’s labour market has generated more jobs this year since emerging from the last recession in 2009. Employment growth and rising incomes are fueling a consumption binge that has made the country’s economy the fasted in the G7. That growth, however, is slated to slow in the current quarter as exports have declined for three consecutive months and housing activity has moved off its peak, especially in the Greater Golden Horseshoe around Toronto.

Faster wage growth, which should eventually feed through to higher prices, supports the Bank of Canada’s view that inflation will return to its two per cent target over the next year. After a more dovish speech by Governor Poloz last week trimmed the odds of another rate hike this year, today’s report has led some commentators to suggest another increase before yearend is likely. Much will depend on the pace of overall economic activity, which is slowing. Today’s jobs report is consistent with our view that growth is tailing off to the 2.0%-to-2.5% range, well below the booming 4.5 per cent pace posted in Q2.

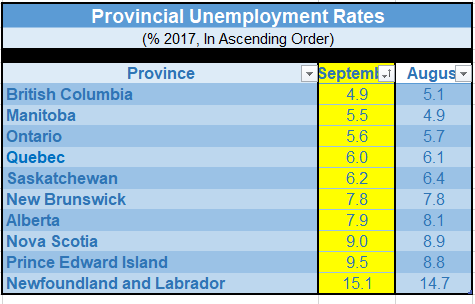

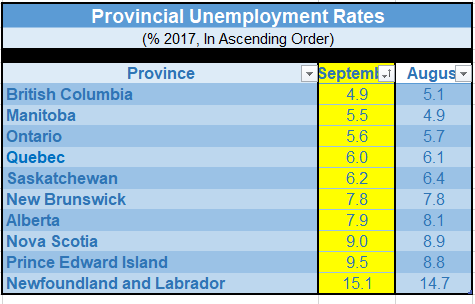

The unemployment rate at 6.2 per cent is the lowest in decades except for the period just before the financial crisis in 2008-09 when the economy was running full out.

According to StatsCanada, Ontario was the only province with a notable employment gain for the second consecutive month. There were employment declines in Manitoba and Prince Edward Island. Most of the job gains were in the public sector where educational services led the way, offsetting the losses in August. As well, more people worked in wholesale and retail trade in September, while employment fell in information, culture and recreation. Construction jobs were flat, and real estate related jobs edged down a bit.

Some Other Details In The Canadian Report

• Hours worked are up 2.4 per cent from a year earlier, the most significant annual increase since June 2012

• Total employment is up by about 320,000 over the past 12 months, driven by 289,000 new full-time jobs

• Youth unemployment fell to 10.3 per cent, the lowest on record, as their participation rate dropped. That reflected an increase in the full-time school attendance rate to the highest since 2011

Hurricanes Hit U.S. Payrolls

The number of employees on U.S. payrolls dropped in September for the first time since 2010. Nonfarm payrolls fell 33,000 while the unemployment rate plummeted two ticks to 4.2 per cent–a 16-year low–and wage gains accelerated. This seeming inconsistency is the result of the separate surveys used to determine each of these numbers. As well, hurricanes Harvey and Irma prevented 1.47 million people from going to work, the most since January 1996. Hourly workers are typically not paid unless they show up for work, regardless of reason.

The U.S. Labour Department suggests that hurricanes had a net effect of reducing the employment numbers in September, while there was “no discernible effect” on the national unemployment rate, which at 4.2 per cent is the lowest since February 2001. The U-6, or underemployment rate, fell to 8.3 per cent from 8.6 per cent; this measure includes those who are involuntarily working less than full-time and people who want a job but aren’t actively looking.

Very tight labour markets boosted average hourly earnings by 0.5 per cent month-over-month taking the year-over-year gain to 2.9 per cent. Some of this increase probably reflects the lower-paid workers that couldn’t make it to work because of the weather. It will be several months before the weather-related effects wash out.

There is nothing in this report that changes my view that the Fed will hike interest rates one more time before the year is out.