Hopefully the first rate drop of many! Message me if you have questions. Prime now 6.95%. Variable Rate Mortgage and Home Equity Line clients to start feeling some relief.

Bank of Canada Rate Decrease

Posted by: Cory Kline

Each Office Independently Owned & Operated

Posted by: Cory Kline

Hopefully the first rate drop of many! Message me if you have questions. Prime now 6.95%. Variable Rate Mortgage and Home Equity Line clients to start feeling some relief.

Posted by: Cory Kline

|

Posted by: Cory Kline

|

Posted by: Cory Kline

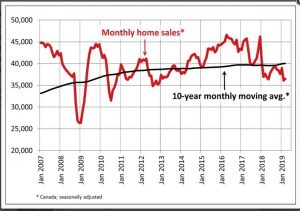

Statistics released Monday by the Canadian Real Estate Association (CREA) show that national home sales edged higher in March following the sharp decline in storm-struck February. Overall, however, housing activity remains considerably below historical norms.

Home sales rose 0.9% nationally while the benchmark price rose 0.8%. While this is an improvement from the very poor showing in February, both sales and prices were down from a year earlier as homebuyers grapple with stricter mortgage rules and provincial actions, especially in British Columbia, to slow the housing market.

There was an even split between the number of markets where sales rose from the previous month and those where they fell. Among Canada’s larger cities, activity improved in Victoria, the Greater Toronto Area (GTA), Oakville-Milton and Ottawa, whereas it declined in Greater Vancouver, Edmonton, Regina, Saskatoon, London and St. Thomas, Sudbury and Quebec City.

On a year-over-year (y/y) basis, sales fell 4.6% nationally to its weakest level for the month since 2013. Existing home sales were also almost 12% below their 10-year average for the month of March (see chart below). Notably, home sales in B.C., Alberta and Saskatchewan were more than a whopping 20% below their 10-year average for the month. The slump is getting deeper in Vancouver, Calgary and Edmonton. All three markets saw further sales and price declines in March. Demand-supply conditions in Vancouver are now the weakest since the 2008-09 recession. By contrast, activity is running well-above average in Quebec and New Brunswick.

There was a slight pick-up in Toronto, yet the 1.8% sales gain recorded last month reversed just a fraction of the outsized 9.0% drop in weather-weakened February. A sixth consecutive decline in new listings in Toronto might have been a restraining factor.

Activity rebounded in Ottawa, while it was flat in Montreal. Both markets, along with Halifax, still boast the tightest demand-supply conditions in Canada. Benchmark prices there continue to track higher at solid rates.

“It will be some time before policy measures announced in the recent Federal Budget designed to help first-time homebuyers take effect,” said Jason Stephen, CREA’s President. “In the meantime, many prospective homebuyers remain sidelined by the mortgage stress-test to varying degrees depending on where they are looking to buy.”

“March results suggest local market trends are largely in a holding pattern,” said Gregory Klump, CREA’s Chief Economist. “While the mortgage stress test has made access to home financing more challenging, the good news is that continuing job growth remains supportive for housing demand and should eventually translate into stronger home sales activity pending a reduction in household indebtedness,” he added.

New Listings

The number of newly listed homes rose 2.1% in March. New supply rose in about two-thirds of all local markets, led by Winnipeg, Regina, Victoria and elsewhere on Vancouver Island. By contrast, new listings declined in the GTA, Ottawa and Halifax-Dartmouth.

With new listings having improved more than sales, the national sales-to-new listings ratio eased to 54.2% from 54.9% in February. This measure of market balance has largely remained close to its long-term average of 53.5% since early 2018.

Based on a comparison of the sales-to-new listings ratio with the long-term average, two-thirds of all local markets were in balanced market territory in March 2019.

There were 5.6 months of inventory on a national basis at the end of March 2019, in line with the February reading and one of the highest levels for the measure in the last three-and-a-half years. Still, it is only slightly above its long-term average of 5.3 months.

Housing market balance varies significantly by region. The number of months of inventory has swollen far above its long-term average in Prairie provinces and Newfoundland & Labrador; as a result, homebuyers there have an ample choice of listings available for purchase. By contrast, the measure remains well below its long-term average in Ontario and the Maritime provinces.

Home Prices

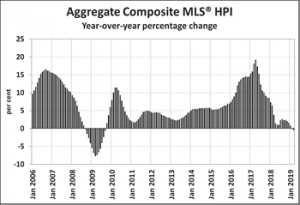

The Aggregate Composite MLS® Home Price Index (MLS® HPI) declined by 0.5% y/y in March 2019. It last posted a y/y decline of similar magnitude in September 2009.

Among benchmark property categories tracked by the index, condo apartment units were the only one to post a y/y price gain in March 2019 (+1.1%), while townhouse/row unit prices were little changed from March 2018 (-0.2%). By comparison, one and two-storey single-family home prices were down by 1.8% and 0.8% y/y respectively.

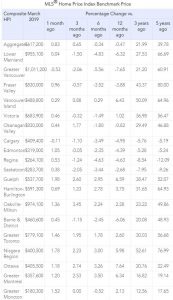

Trends continue to vary widely among the 18 housing markets tracked by the MLS® HPI. Results remain mixed in British Columbia, with prices down on a y/y basis in Greater Vancouver (-7.7%) and the Fraser Valley (-3.9%). Prices also dipped slightly below year-ago levels in the Okanagan Valley (-0.8%). By contrast, prices rose by 1% in Victoria and by 6.4% elsewhere on Vancouver Island.

Among Greater Golden Horseshoe housing markets tracked by the index, MLS® HPI benchmark home prices were up from year-ago levels in Guelph (+6.6%), the Niagara Region (+6.0%), Hamilton-Burlington (+3.7%) the GTA (+2.6%) and Oakville-Milton (+2.3%). By contrast, home prices in Barrie and District held below year-ago levels (-6.1%).

Across the Prairies, supply remains historically elevated relative to sales and home prices remain below year-ago levels. Benchmark prices were down by 4.9% in Calgary, 4.4% in Edmonton, 4.6% in Regina and 2.7% in Saskatoon. The home pricing environment will likely remain weak in these cities until demand and supply become more balanced.

Home prices rose 7.6% y/y in Ottawa (led by a 10.4% increase in townhouse/row unit prices), 6.3% in Greater Montreal (led by an 8.1% increase in apartment unit prices) and 2.1% in Greater Moncton (led by a 12.9% increase in apartment unit prices). (Table below).

Bottom Line:

The absence of a sharp snapback in activity at the beginning of the all-important spring season in March clearly points to the mortgage stress test, market-cooling measures in BC, economic uncertainty in Alberta and stretched affordability as continuing to exert significant restraint on homebuyer demand. The bad weather’s effect on February sales may have been limited after all. This means that the spring season may not have much upside to offer this year. In coming months, the recent declines in mortgage rates should ease the stress test for some buyers and we will see if first-time home buyers decide to put their plans on hold until more details on the federal government’s First-Time Home Buyer Incentive become available.

It has become increasingly apparent that the taxes levied in Vancouver targeting foreign buyers, empty homes, and high-end properties have sent Vancouver’s luxury housing market reeling. Prices in West Vancouver, one of Canada’s richest neighbourhoods, are down 17% from their 2016 peak. The slowdown is broadening: home sales in March were the weakest since the financial crisis as the benchmark prices fell 8.5% from their record last June. Bloomberg News published the following story today:

“It’s become more costly to both buy and own expensive homes (in Vancouver), particularly for non-resident investors and foreigners. To get a sense of the impact from the municipal, provincial and federal measures, take as a hypothetical example, the province’s most valuable property: the C$73.12 million ($55 million) house belonging to Vancouver-based Lululemon Athletica Inc. founder Chip Wilson. A foreign purchaser of the home who leaves the property empty for much of the year would end up paying as much as C$20.8 million in taxes as follows:

Taxes on purchase:

• Foreign buyers’ tax of 20%: C$14.6 million surcharge on top of the sales price

• Property transfer tax rate climbs to 5% on most expensive homes: C$3.7 million

Ownership taxes:

• Municipal vacancy tax of 1% on assessed value: C$731,200 a year

• Provincial speculation and vacancy tax, 2% of assessed value: C$1.46 million a year

• Provincial luxury home tax known as the additional school tax of 0.2% to 0.4% of assessed value: C$278,480 a year

Additional government moves:

Federal rules tightening mortgage lending made it harder to obtain larger mortgages and harder for foreign buyers to borrow

Proposed legislation will expose anonymous Vancouver property owners in a public registry to stymie tax evasion, fraud and money laundering.”

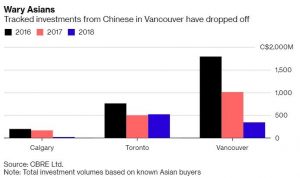

It is not surprising, therefore, that Asian investment–a stalwart part of the Vancouver real estate market for decades–has dropped sharply. “Chinese investors are retreating globally following government restrictions on capital outflows in 2016. In Vancouver, Asian investment dropped off even more last year due in part to a series of new taxes instituted by the government, including a speculation and wealth tax on homes. The province has also proposed a bill to expose hidden landowners — both residential and commercial — and failure to disclose may result in a fine of C$100,000 or 15% of the property’s assessed value, whichever is greater. This is apparently already driving away some investors.” Bloomberg News has reported that at least some Chinese money is being diverted from the Vancouver market to Toronto as shown in the following Bloomberg chart.

Dr. Sherry Cooper

Chief Economist, Dominion Lending Centres

Posted by: Cory Kline

In this year’s budget, the federal government announced a program for first-time homebuyers that would offer between 5% and 10% top up from the Canada Mortgage and Housing Corporation.

If you’re buying a brand new home, the CMHC will give you 10% of the total cost, and it will offer 5% if it’s an older construction.

The idea is to give people struggling to afford their first home a break on their monthly mortgage payments. Buyers would still need to put down at least a 5% down payment. Families will have to have a net income of less than $120,000 to qualify, according to news reports.

Posted by: Cory Kline

When the Bank of Canada decided this month to keep its benchmark interest rates stable at 1.75%, it signalled the weakening economy makes it unlikely a rate increase is anywhere on the horizon.

Inflation is not where it should be, we’re not in a deflation mode right now, but inflation is under control and there’s no real need for them to raise interest rates.

Because many of the economic indicators are pointing downward, this puts the bank in a position where it can’t raise rates. This makes refinancing a more attractive option for some homeowners this year.

A lot of economists are saying that Canada is heading back into another crisis, which is an indicator that rates may drop again. This new norm will probably stay around for a little while, but rates will eventually go up. And when it goes up, people have to be obviously prepared for it.

So, for now, homeowners shouldn’t worry too much about a sudden jump in rates. While this may be a new normal, if the economy begins a turnaround, they should be ready for a bump in rates, but I don’t think it’s going to happen the next couple of years.

Usually, Canada’s economy runs almost parallel to that of our southern neighbour’s. However, the two economies seem to have gone their separate ways lately.

There’s a divergence right now that is going to occur between the Canadian and U.S. economies. When people talk about the U.S. sneezing and Canada catches a cold—this is not what’s happening right now. There’s a divergence in the interest rates. Where in the States rates are going up, in Canada, rates cannot go up because of the way our economy is actually going.

Thank you Terry Kilakos for your insight.

#MortgageRates #Refinance

Posted by: Cory Kline

At the start of every New Year, pundits posit the forecast as everyone wonders what the year will bring. While no one has a crystal ball, here are some fundamentals at play this year:

1). Canada’s economy will continue to under perform the U.S. as growth slows to 1-3/4% in 2019 compared to just over 2% in 2018. For the U.S., where budget deficits have been rising sharply with the 2018 tax cuts, growth this year will hit about 2.4% compared to nearly 3% last year–an over-heated economy to say the least.

2.) Canada’s population growth will lead the G7 by a wide margin. In 2018, Canada’s population was on track to increase 1.4%, the most robust pace in 18 years and double the 0.7% rate for the U.S., which was the G7 country with the next-highest population growth rate. Despite this, spending did not rise —auto sales fell on an annual basis for the first time since 2009, while home sales had their second biggest slide in the past 20 years. Per capita GDP growth in Canada this year will under perform most of the G7.

Strong (net) immigration accounted for almost half (45%) of Canada’s population increase last year. That contribution will only grow since Ottawa has committed to boosting its annual immigration target from 310,000 new permanent residents in 2018 to 331,000 this year (up 6.7%) and to 350,000 by 2021. About two-thirds of 2019’s expansion will come from the immigration programs that target highly skilled workers aimed at addressing labour shortages across Canada.

As well, the number of non-permanent residents reached an all-time high of 166,000 last year accounting for one-third of the growth in the population. This group includes temporary foreign workers, international students and asylum seekers. All three categories soared, reflecting strong demand for skilled labour, Canada’s growing reputation as a desirable place to obtain post-secondary education, and increases in cross-border refugee claimants.

3.) Canadian consumers are tapped out as debt levels remain high, interest rates edging upward and credit is less readily available. Boomers are wary that their homes are worth less than what they were counting on as Canada’s two largest housing markets experienced decade-low sales last year with softer prices especially at the pricier end of the single-family home market. First-time buyers might have more homes to choose from in some markets, but regulators have tightened qualification rules. Foreign buying has slowed owing to foreign purchaser taxes in Toronto and Vancouver and speculation taxes in Vancouver.

4.) The Fed and the Bank of Canada will raise rates in 2019 by more than the market currently expects. Market participants in recent weeks have reduced expectations for rate hikes by both central banks to barely one increase apiece. More likely, both the Fed and the BoC will raise the benchmark overnight rate twice each this year. Even with these actions, monetary policy in both countries will be slightly accommodating with interest rates still below neutral levels.

5.) Even with only modest rate increases in 2019, consumers will be impacted because they are so heavily exposed to debt. Economists at the Royal Bank estimate that the average household faces a $1,000 hit from rate hikes. This would imply that the average household principal and interest payment will increase by 7.6% in 2019.

6.) This effect will be offset by stronger wage growth as labour markets continue to tighten. Labour shortages will finally add to wage growth. The unemployment rate hit a record low in December, yet wage growth had slowed to only 1.5% year-over-year, well below inflation. Over the next decade, more than 270,000 people will retire from the Canadian labour market every year. Immigrants and temporary workers will replace some of these retirees, but not all.

Recent data suggest that the quit rate–the proportion of the labour force that leaves their jobs voluntarily–is rising. This portends higher wage rates going forward.

7.) Rising interest rates will squeeze government spending for the feds and provinces with significant debt loads. Ottawa will spend more on debt payments than any other program except elderly benefits.

8.) Corporate balance sheets will be negatively impacted by higher interest rates as Canadian companies borrowed more heavily than their international counterparts. Canadian companies remain less competitive as their productivity growth has lagged their global competitors. Efforts to improve Canadian competitiveness are in process but have yet to show meaningful results. This has been a secular problem for Canada.

9.) Canada could be caught in the crosshairs of a U.S.-China trade war, but free-trade deals with Europe (CETA) and China (CPTPP) will reap benefits, particularly as the U.S. continues to alienate many of its allies and trading partners. Canada must diversify trade away from the U.S., particularly in the oil sector, which requires massive infrastructure spending. No longer can we count on exports of oil and transportation products to the U.S. to be the mainstay of Canadian global trade.

10). Comparable to last year, housing in 2019 will not fuel Canada’s national economy, thanks to macroprudential policy measures and modestly higher interest rates. Housing accounted for a record-high percentage of overall economic growth and job creation until early last year. We are barely off those peak levels now, so any slowdown in housing activity will have a disproportionately large negative impact on the economy–the flip side of its disproportionate expansionary impact over much of the prior decade.

Bottom Line: Sales to new listings have stabilized in Toronto, but continue to decline in Vancouver. Population growth in Vancouver has under performed Toronto’s for two years, while supply, mainly in the high-rise segment, has risen sharply. In consequence, the number of completed and unabsorbed units in Vancouver continues to increase, while that measure is still trending downward in Toronto. The sector of most significant weakness in Toronto will continue to be in the pre-sale low-rise market where there remains considerable excess supply.

Dr. Sherry Cooper

Chief Economist, Dominion Lending Centre

Posted by: Cory Kline

Did you know that 60 per cent of people break their mortgage before their mortgage term matures?

Most homeowners are blissfully unaware that when you break your mortgage with your lender, you will incur penalties and those penalties can be painfully expensive.

Many homeowners are so focused on the rate that they are ignorant about the terms of their mortgage.

Posted by: Cory Kline

2017 was a year of change for the Canadian Mortgage Market. With the announcement of the B-20 guideline changes requiring all insured or uninsured mortgages to undergo stress testing. In addition, the removal of mortgage bundling and the continued rate rises from the Bank of Canada have led to significant changes in mortgage rates.

This raises the question: what does 2018 hold? While we cannot be 100% certain, based on predictions and summarizing stats from various corporations, we are able to put together a strong prediction of what 2018 will hold.

CLICK TO READ MORE