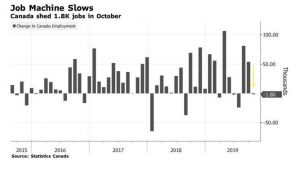

Statistics Canada announced this morning that the country lost 1,800 jobs in October following two months of blockbuster employment gains. October marks the first month of job losses since July, but as the chart below shows, the employment data are notoriously volatile. The Canadian dollar sold off on the news of the small job loss. Even with the slight drop in October, job gains so far this year are the strongest in 17 years. The country has added 391,00 jobs in the first ten months of this year.

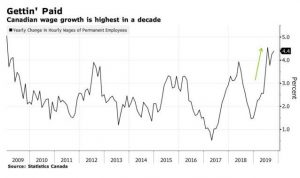

The labour market remains a bright spot for the Canadian economy, and income growth has boosted consumer spending and housing this year. The unemployment rate remained at a mere 5.5% in October–just one tick above a 45-year low–and best of all, wage gains for permanent employees surged 4.4% year-over-year, the best reading in ages. Accelerating wage growth is a sign that the tight labour market is boosting pay. With overall inflation at only 2% or less, real family purchasing power is rising. As well, hours worked advanced 1.3% from a year earlier, matching September’s pace.

There is nothing in this report that changes the Bank of Canada’s likely actions. I believe the Bank will remain on the sidelines when it meets again in December, but could well take an “insurance” rate cut early next year. Bank of Canada Governor Stephen Poloz, one of the few central bankers to resist the global push for lower interest rates, acknowledged he’s begun to consider the merits of joining other countries in lowering borrowing costs. Currently, Canada has the highest overnight interest rate among the majors, as the US once again cut rates late last month. Poloz said that the Bank of Canada “is mindful that the resilience of Canada’s economy will be increasingly tested as trade conflicts and uncertainty persist.” The Bank of Canada remains bullish on consumption and housing — which are being fueled by a robust labour market.

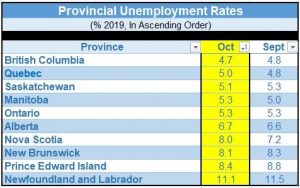

In October, employment increased in British Columbia and Newfoundland and Labrador and was little changed in the other provinces. Employment declined in manufacturing and construction. At the same time, net new jobs were up in public administration and finance, insurance, real estate, rental and leasing. The number of self-employed workers decreased, while the number of employees in the public sector increased for the second consecutive month.

|

|

|